Published on June 27, 2019 by Suresh Chavali

In September last year, one of the largest Dutch banks agreed to pay USD900m in a settlement with the Dutch Public Prosecution Service (DPPS) relating to its poor anti-money laundering controls. The investigation established ‘serious’ deficiencies on the part of the bank, the customer due diligence (CDD) files were missing or incomplete in some cases and the customer segmentation was indeed terribly wrong.

CDD refers to the steps taken by an organization to

-

Establish the identity of a customer

-

Understand the nature of the customer’s activities

-

Evaluate risks of money laundering associated with the customer for monitoring the transactions

Especially when entering into a business relationship with customers operating in risky geographies where corruption is rampant or in sectors that have a high probability of being involved in potential corruption, such as the oil and gas industry, an enhanced or investigative due diligence approach is required to mitigate the risks and make informed business decisions.

What is investigative due diligence (IDD)?

It is a specific due diligence process that is completely independent and, therefore, relies very little on the documentation provided by the subject (entity or individual) in question.

The following are the two main components of IDD:

-

Research

-

Deriving insights

Research: Traditional search engines such as Google or Bing are remarkably strong tools, but their coverage and reliability are limited, and it can be difficult to wade through the abundance of information they carry to identify what is exactly required. For example, a Google search for “Wang Wei” – a reasonably common Chinese name – returns more than 1.7m results. Among the numerous Wang Weis with an online presence are a poet, an entrepreneur, an artist, a university professor, and a former Chinese government official.

It is clear, therefore, that a due diligence investigator needs to be sufficiently skilled to cut through the irrelevant results and identify the correct subject. The criteria for elimination of false positives, which are frighteningly common, must be chosen carefully, ensuring no true positives are excluded.

As mentioned earlier, open searches have their limitations, such as the inability to obtain information from a paid source or information stored in online documents that the public is legally prohibited from accessing. Generally, a substantial amount of critical information can be obtained from sources such as litigation history, and bankruptcy and credit details. We believe it is vital to include such information in a due diligence report.

Deriving insights: Our first instinct when we see data is to find patterns and relationships – to gather meaningful information and insights.For example, if one of the beneficial owners of an entity in question is a politically exposed person, and has been accused by the leader of the opposition for corruption and inability to run the government over the years.

While performing due diligence, the investigators should carefully read through the pile of information regarding the accusations, cut through the irrelevant results, read through the meaningful reports/articles and see whether there is evidence to support the accusation and is yes has there been any corrective action taken by the judiciary system of the country in question. With all these insights in place, the investigators should assess the direct impact of the acquisitions, on the entity in question and then classify the risk accordingly.

The top three benefits of IDD

-

Enables your organization to make fully informed financial and business decisions

-

Safeguards your organization from making mistakes that could be financially devastating and from entering into contracts with illegitimate companies or individuals regarding whom there is adverse news

-

Affords a clear picture of the health of an entity your organization is dealing with

How Acuity can help

When conducting IDD, Acuity brings together its comprehensive data source on global companies, team of skilled research analysts and access to its Innovation Lab (the Business Excellence and Automation Tools team that builds customized products).

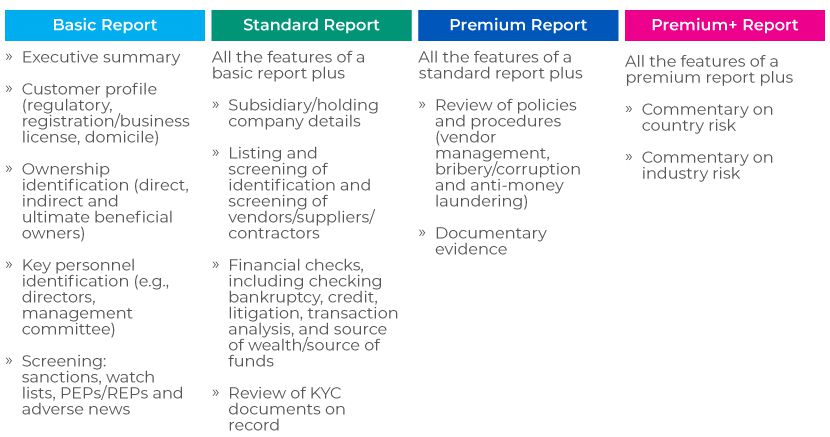

Acuity has a suite of IDD reports that are tailor-made to meet specific needs of organizations.

How are Acuity reports different?

All due diligence reports are compiled using the EPIC methodology:

-

Extracting information from structured data sources

-

Populating missing information from unstructured data sources

-

Investigating and analyzing information

-

Calculating risk

Due diligence reports are compiled from numerous corroborating public sources and information available from various international and regional regulatory bodies. Our expert team of due diligence analysts makes sure that the reports are generated in the shortest possible time, without compromising quality.

The Acuity advantage

-

Access to an exclusive source of company information (Bureau van Dijk: Orbis)

-

Our research pedigree and expertise

-

Access to our Innovation Lab to build customized, next-gen KYC/AML solutions

-

Incorporating best practices in KYC/AML procedures implemented by industry leaders

-

Efficient due diligence life-cycle management, reducing up to 30% in operating costs

What's your view?

About the Author

Suresh Chavali has over 11 years of experience in compliance, having worked for various firms including Barclays and Deutsche Bank. His expertise spans across the risk and compliance sector, focusing on know your customer (KYC) and risk management. At Acuity Knowledge Partners he is responsible for Pre-sales and Product Management support to Compliance Services. Suresh has done his engineering from JNTU Hyderabad.

Like the way we think?

Next time we post something new, we'll send it to your inbox